4. Historic Trends, Recent Developments and Forecast Growth

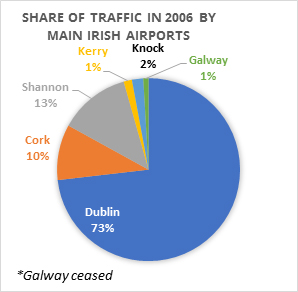

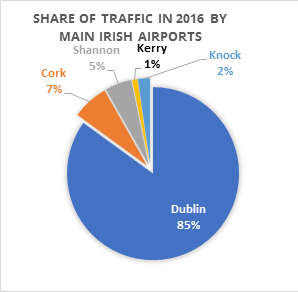

Within Ireland, Dublin Airport’s role in the aviation sector has grown in importance over the last ten years. Between 2006 and 2016 Dublin Airport’s share of the national market has grown from 73% to 85%.

Figure 6: Irish Airports Traffic Share

Source: Department of Transport, Tourism and Sport

Since 2010, Dublin Airport has witnessed an extended period of strong passenger growth as part of Ireland’s post-recession recovery as illustrated in Figure 7, Dublin Airport Passenger Numbers 2006 - 2017.

The average number of passengers carried per aircraft movement has also increased, continuing the trend that has seen larger and more modern aircraft types used at the airport. With the growth plans of both Aer Lingus and Ryanair, this recent momentum is expected to continue – at least in the short term. Thereafter potential capacity constraints or the impacts of Brexit make the longer-term picture less clear.

In total, Dublin Airport is served by 63 scheduled passenger airlines flying to a comprehensive range of short haul and long-haul destinations (around 180 in 2017 if both scheduled and charter services are also included). UK destinations account for 38.4% of all departing seats from Irish airports in 2017, with the links from Dublin to London’s Heathrow and Gatwick airports the largest by departing capacity, and Manchester and Birmingham also substantive.

In addition, there is also evidence of increased interlining at Dublin, up from less than 1% five years ago to nearly 3% of departing seats in 2017. Dublin also offers smaller UK regional airports a hub link between the UK and North America. Based on these trends, recent evidence suggests that Dublin will continue to grow, provided additional capacity is available to support this growth.

Figure 7: Dublin Airport Passenger Numbers 2006 - 2017

Source: Department of Transport, Tourism and Sport

In 2017 the Department of Transport Tourism and Sport (DTTAS) commissioned a review into the future capacity needs at Ireland’s State Airports up to 2050. It is indicated that in addition to considering airside and landside capacity issues the study will look at options around the type, financial/regulatory structures, timing and location of any future terminal at Dublin Airport.

Airfreight, Business Aviation and Maintenance, Repair and Overhaul of aircraft are also important parts of the airport’s business mix as 142,000 tonnes of air freight used Dublin in 2017 and there is a substantial MRO (Maintenance, Repair and Overhaul) operation at the airport creating substantive levels of employment.

With regard to recent trends and growth, we invite you to consider the following questions:

- What are your views, aspirations or concerns surrounding the future growth of Dublin Airport?

- What are the key issues associated with any future growth that you foresee for the preparation of the Airport LAP?